Cloud-native RegTech Platform for KYC processes.

With trak.e we simplify compliance processes, facilitating business growth so that financial entities may know their customers and may automate monitoring processes, document verification, risk profile calculation / transactional profiles and checklists.

Cloud-native RegTech Platform for KYC processes.

With trak.e we simplify compliance processes, facilitating business growth so that financial entities may know their customers and may automate monitoring processes, document verification, risk profile calculation / transactional profiles and checklists.

It streamlines KYC processes by having an end-to-end vision of customer’s behavior through digital files.

It performs automatic checkups on private lists, public lists and entity’s own databases.

It monitors customer’s activities continuously and in real time, with the possibility of setting up required rules and alerts.

It brings efficiency to Money Laundering Prevention Teams so as to detect abnormal behavior rapidly and take action.

It streamlines KYC processes by having an end-to-end vision of customer’s behavior through digital files.

It performs automatic checkups on private lists, public lists and entity’s own databases.

It monitors customer’s activities continuously and in real time, with the possibility of setting up required rules and alerts.

It brings efficiency to Money Laundering Prevention Teams so as to detect abnormal behavior rapidly and take action.

trak.e is based on FATF international recommendations,

enabling entities to make it customizable so as to comply

with Money Laundering Prevention policies as well as

Terrorism Financing policies.

enabling entities to make it customizable so as to comply

with Money Laundering Prevention policies as well as

Terrorism Financing policies.

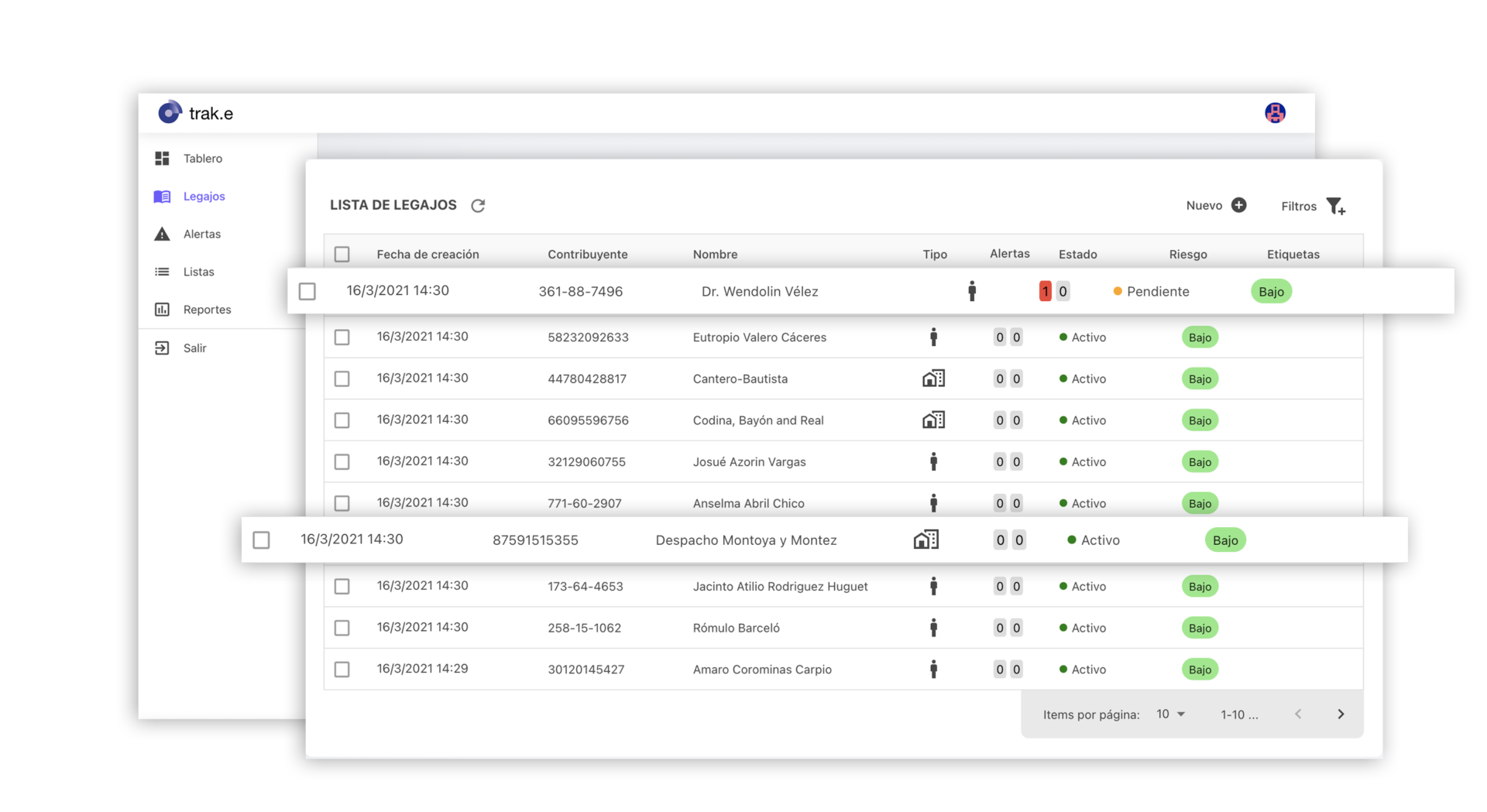

Digital file

Digital file is trak.e’ s main resource, in which information on the KYC compliance process is concentrated. Customization of elements and features of the file.

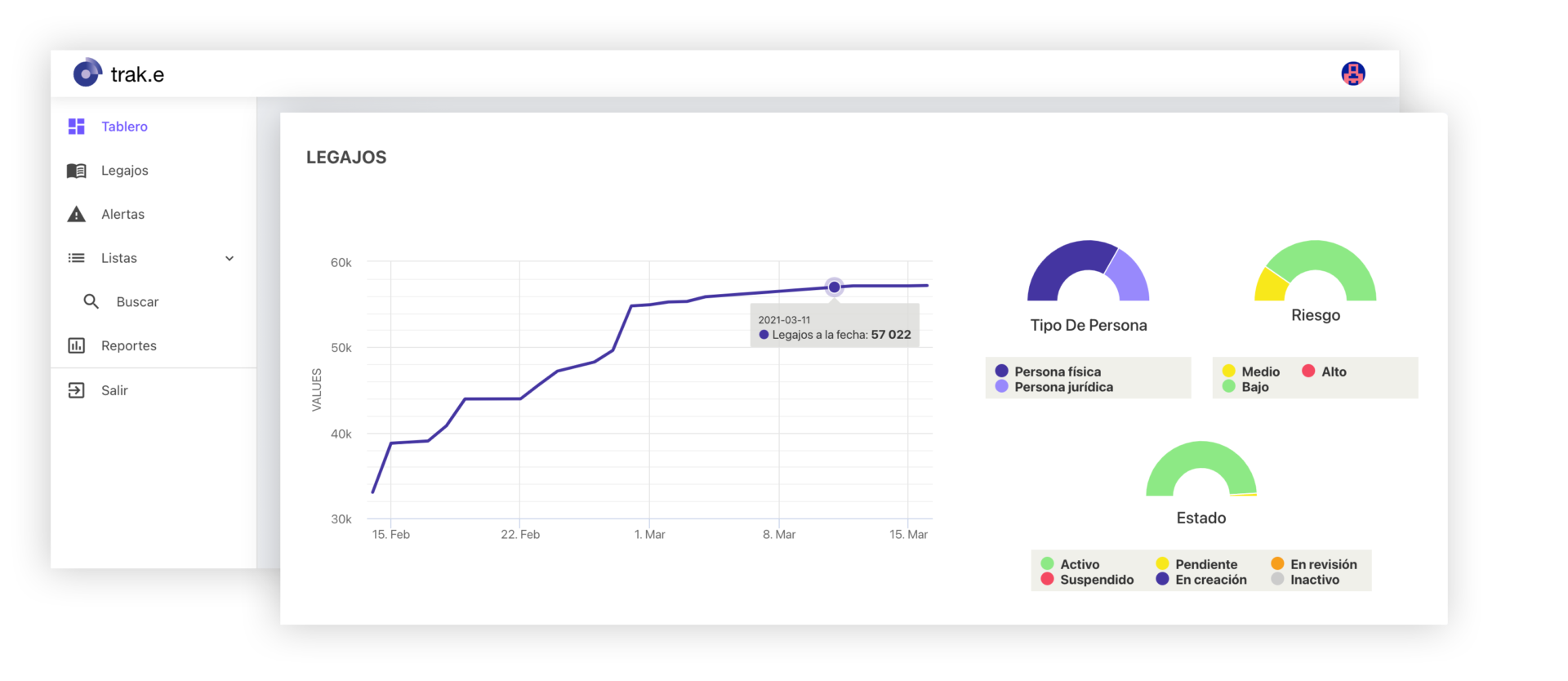

Transactional monitoring

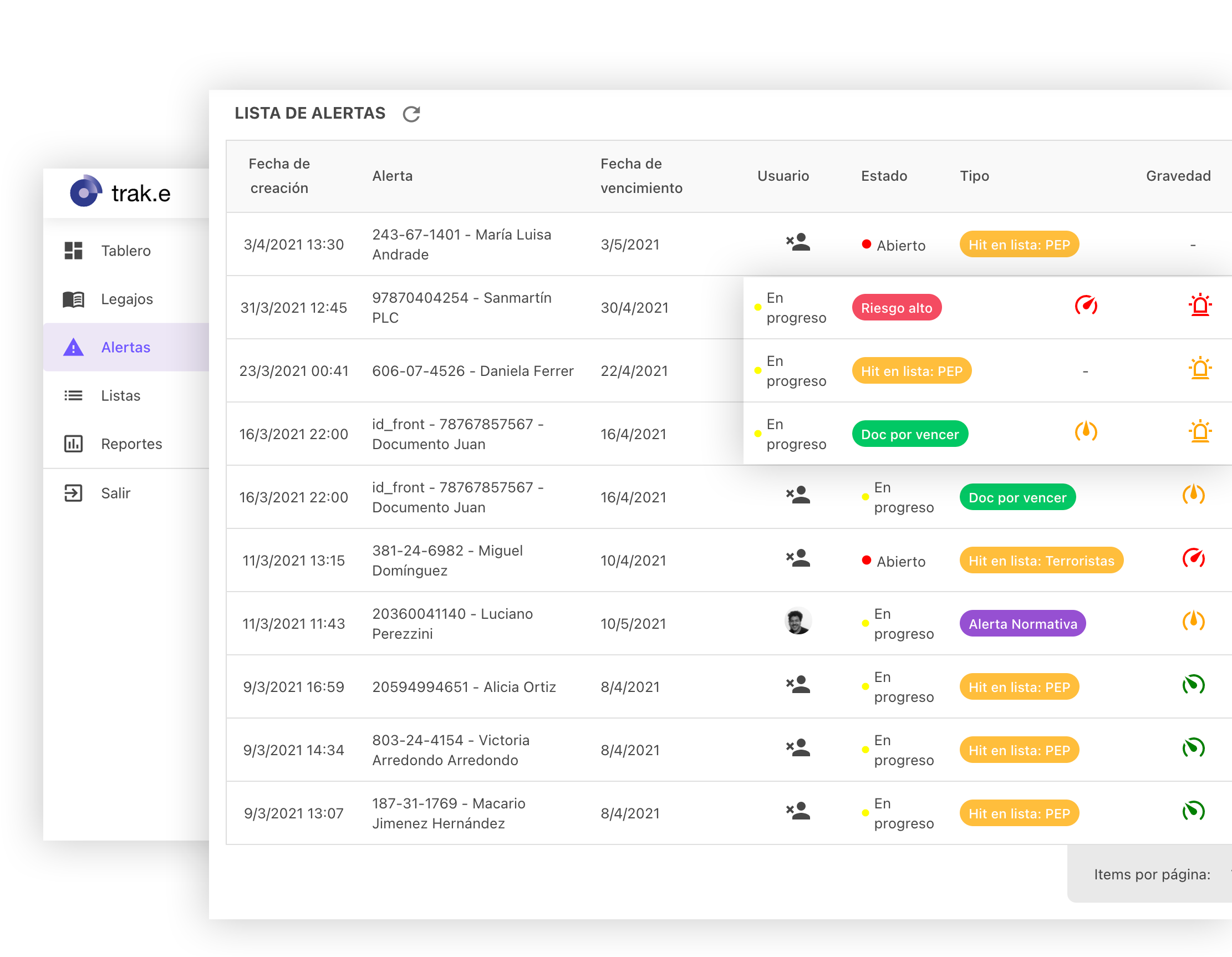

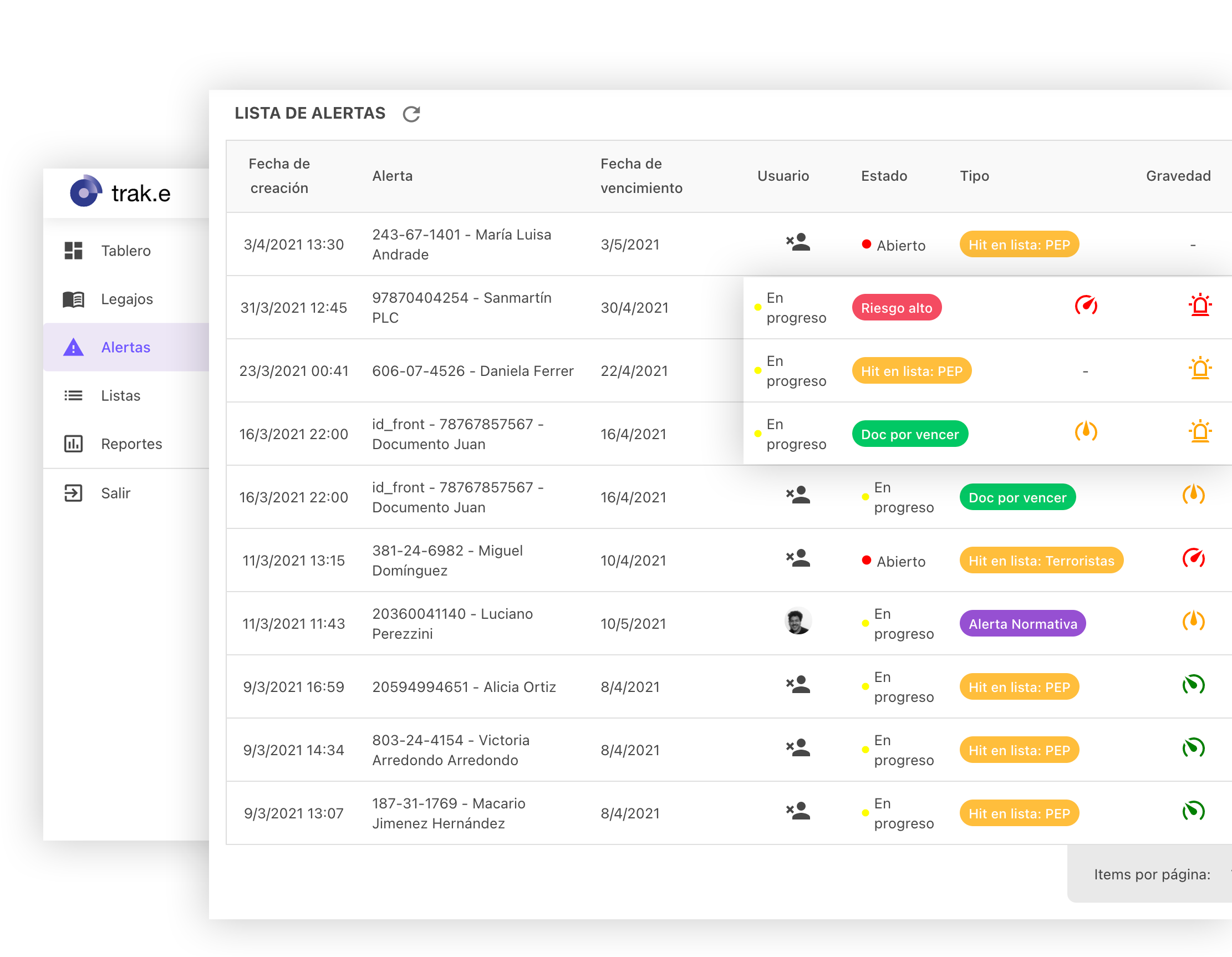

Continuously monitoring of customer activity in real time, generating alerts that allow to analyze customer behavior.

Due diligence

Preset to comply with Simplified and Reinforced Due Diligence processes, pursuant to customer risk profile.

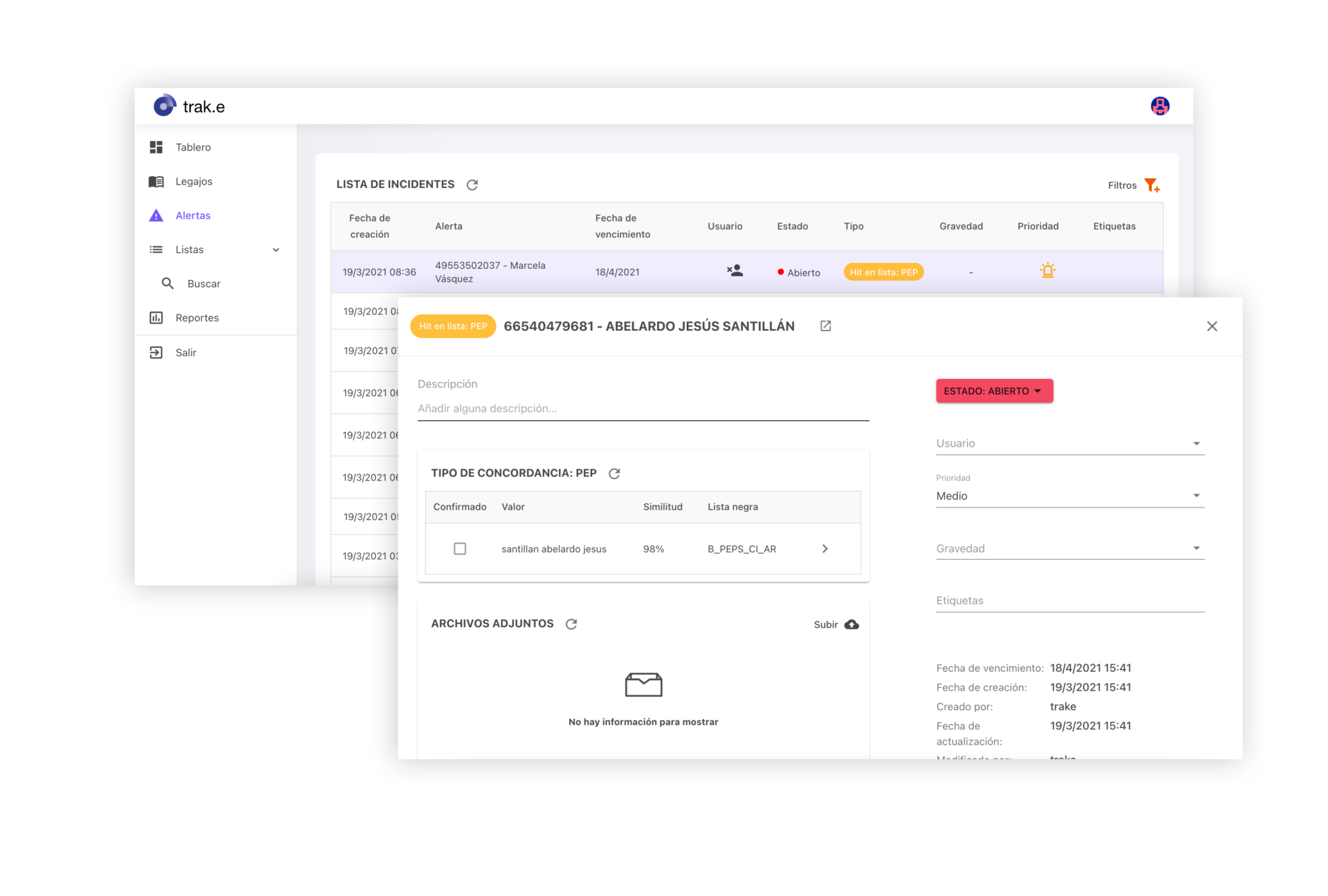

Rules & alerts

Rules and alerts setup to monitor customers continuously so as to comply with guiding principles of Money Laundering Prevention Management, Terrorism Financing and Due Diligence procedures.

Customer profile

It allows defining the transactional profile and customer risk profile, pursuant to regulatory framework and entity ́s internal policies.

Checklists

It validates lists automatically and periodically, thus shortening operative data entry and manual verification.

– It is included in Argentina’s public lists as well as in international public lists.

– Ability to integrate with suppliers of world – class lists.

– It is included in Argentina’s public lists as well as in international public lists.

– Ability to integrate with suppliers of world – class lists.

trak.e provides a powerful rule engine

for fraud prevention and detection.

for fraud prevention and detection.

trak.e solves the regulatory complexities of various regulated financial sector players.

0

Managed Files

0

Daily Registrations

0

Daily Transactions

We accompany the transformation of KYC processes

for the scaling of digital businesses.

Trusting Poincenot